Juuli Review: Why This Platform Is a Game-Changer for Freelancers

In today’s fast-paced gig economy, managing finances efficiently is crucial for freelancers striving to maintain their independence and productivity. This is where Juuli steps in as a true game-changer. In this Juuli review, we’ll explore why this invoicing and payment platform is rapidly becoming the go-to choice for freelancers worldwide.

Juuli isn’t just another financial tool; it’s a comprehensive solution designed to simplify the complexities of freelance financial management. With its intuitive interface, transparent fee structure, and a suite of integrated financial features, Juuli aims to empower freelancers, allowing them to focus more on their work and less on administrative hassles.

Whether you’re just starting out or are a seasoned freelancer, Juuli offers the tools and support needed to streamline your financial processes, making invoicing and getting paid a walk in the park. Ready to transform the way you handle your freelance earnings? Let’s dive into the review to see why it’s a preferred choice for many.

Affiliate Disclosure

We prioritize transparency with our readers. If you purchase through our affiliate links, we may earn a commission at no additional cost to you. These commissions enable us to provide independent, high-quality content to our readers. We only recommend products and services that we personally use or have thoroughly researched and believe will add value to our audience.

Table of Contents

Key Features

Hassle-Free Setup

Juuli’s payment platform designed with freelancers in mind makes the creating invoices process a breeze. Imagine setting up your account in less time than it takes to brew your morning coffee. Within just 10 minutes, you’re ready to start creating and sending invoices to your clients.

There’s no need to worry about opening a separate bank account, setting up a company, or handling cumbersome contracts. Juuli has streamlined everything for you, ensuring that you can focus on what you do best – your work. With Juuli, you can log in from anywhere and manage your finances effortlessly.

The user-friendly site and intuitive interface guide you every step of the way, making the transition smooth and enjoyable. Get ready to transform how you handle your earnings and see why so many freelancers consider Juuli a game-changer for managing their money!

Compliance and Security

When it comes to managing your finances, compliance and security are top priorities. With Juuli, freelancers can rest easy knowing that state-of-the-art security measures protect their payments and personal data.

Juuli ensures automated compliance with regulations and tax laws, allowing you to focus on your work instead of worrying about legalities. The platform’s robust security protocols safeguard your financial transactions, ensuring that every invoice and payment detail remains secure.

By choosing Juuli, you’re opting for a service that prioritizes your privacy and security just as much as you do. With a commitment to protecting your finances, Juuli has built a reputation as a trusted partner for freelancers navigating the gig economy.

So, whether you’re generating an invoice, tracking payments, or managing customer transactions, Juuli’s comprehensive security framework has got you covered, allowing you to concentrate on growing your freelancing career with peace of mind.

Transparent Pricing

One of the standout features of Juuli is its transparent pricing structure. As freelancers, budgeting can be challenging, but with Juuli’s pay-as-you-go model, you’ll only pay for the services you use, eliminating the worry of hidden fees.

Plus, your first invoice is commission-free, offering you a risk-free way to kickstart your financial journey. There’s also no need for a legal entity to use the platform, which means you can start invoicing your clients immediately.

This approach not only saves you time but also simplifies the entire process, allowing you to focus on winning more customers and projects. Whether you’re creating a page or handling multiple client transactions, Juuli ensures your pricing is predictable and fair, making it a reliable ally in your freelancing career.

Discover the ease of managing your finances with Juuli; sign up today and streamline your invoicing process!

Invoicing Capabilities

Juuli transforms the invoicing process into a breezy and efficient experience, catering specifically to the needs of freelancers. Let’s dive into the features that make this platform stand out under the Invoicing Capabilities section.

Fast Invoicing and Payments

Juuli excels in creating a smooth and speedy invoicing flow, ensuring that freelancers get paid swiftly and securely. The platform provides simple invoice creation with ready-to-use templates, allowing freelancers to generate invoices in just a few clicks. This eliminates the hassle of manual entries and reduces the opportunities for error.

After an invoice is created, sending it to clients is a fast and straightforward task, making late payments a thing of the past. Furthermore, Juuli’s secure payment processing ensures that transactions are handled efficiently, providing peace of mind for both freelancers and their clients. This combination of speed and security is essential for maintaining a steady cash flow and fostering positive client relationships.

Customization and Professionalism

Juuli understands that the presentation of invoices is a reflection of a freelancer’s brand and professionalism. The platform offers customizable invoice templates, allowing freelancers to tailor their invoices to reflect their personal or brand identity. This feature helps create a consistent and polished image that can impress clients and establish a professional reputation.

In addition to customization, Juuli ensures that invoices are professional in appearance and easy to track and manage. This helps freelancers stay organized and keep track of their financial transactions, reducing the likelihood of errors or misunderstandings. By combining customization with professionalism, Juuli empowers freelancers to present themselves confidently and manage their invoicing with finesse.

Payment Features

Managing payments as a freelancer can often be a complex and stressful task, but Juuli makes it straightforward and efficient.

Multiple Payment Methods

One of the standout features of Juuli is its support for multiple payment methods, ensuring that clients can easily pay you in the way that suits them best. The platform accommodates a variety of payment options, including credit cards, bank transfers, and popular mobile payment solutions. This flexibility not only makes it convenient for clients to settle invoices promptly but also enhances your chances of getting paid on time.

Furthermore, Juuli’s functionality extends to handling payments in both global and local currencies, making it an ideal choice for freelancers who work with international clients. With automatic currency conversion, you don’t have to worry about exchange rate issues or additional fees, as Juuli does the heavy lifting for you. This feature eliminates the friction of cross-border transactions and allows you to focus on delivering your best work.

No Overseas Bank Account Required

Another impressive benefit that sets Juuli apart is its capability to facilitate payments without the need for an overseas bank account. Many freelancers face the cumbersome process of opening corporate bank accounts abroad, which can be both time-consuming and expensive.

Juuli simplifies this by securely receiving your payments and transferring them directly to your local bank account. This seamless transfer process helps you avoid the complexity and potential charges associated with international banking. Rather than dealing with these additional hurdles, you can enjoy the peace of mind that comes with knowing your earnings will arrive safely and on time.

These payment features clearly illustrate how Juuli is designed to support the needs of freelancers in a global economy. By offering flexible payment options and removing banking obstacles, Juuli helps you manage your freelance finances with ease and confidence.

Advanced Features

When it comes to enhancing the experience for freelancers, Juuli offers advanced features that elevate its platform to a new level. These features are designed to provide maximum convenience and flexibility, ensuring that freelancers can focus on their work without worrying about complex financial transactions.

Dedicated Multi-Currency IBAN

One of Juuli’s standout features is the dedicated multi-currency IBAN, which simplifies financial management for freelancers working with both local and international clients. With a dedicated IBAN, freelancers can handle various currencies with ease, making it more straightforward to receive payments in different denominations. This significantly reduces the hassle of dealing with multiple bank accounts or conversion fees, as Juuli’s platform manages these intricacies behind the scenes.

Moreover, this feature ensures that transactions are seamless and efficient, offering a smoother experience for both freelancers and their clients. The dedicated IBAN also enhances professionalism by providing a consistent and reliable bank account detail, which is particularly useful for fostering trust in international transactions. Overall, the multi-currency IBAN is an invaluable tool for freelancers aiming to expand their global reach without the usual financial headaches.

Financial Ecosystem

Juuli’s financial ecosystem further supports freelancers by integrating a suite of additional tools and services. This holistic approach includes the introduction of a debit card and a credit line, giving users greater financial leverage and flexibility in managing their earnings. The debit card allows instant access to funds, making day-to-day transactions swift and effortless.

Additionally, the ecosystem is designed to aid freelancers in navigating the gig economy with ease. The credit line can act as a financial buffer, providing much-needed support during lean months or in times of unexpected expenses. This integrated approach not only simplifies financial management but also allows freelancers to focus more on their work and less on the complexities of their financial health. With these advanced financial tools, Juuli truly stands out as a comprehensive solution for modern freelancers.

Elevate your freelance career by joining Juuli now and enjoy hassle-free payment solutions tailored to your needs.

Step-by-Step Guide to Using the Platform

Welcome to this step-by-step guide to using the Juuli platform! Whether you’re a freelancer, small business owner, or an entrepreneur, Juuli simplifies your invoicing and payment processes, ensuring a seamless financial experience. Let’s dive in and see how easy it is to get started with Juuli.

Registration and Setup

Getting started with Juuli is straightforward and user-friendly. To begin the registration process, visit the Juuli website and click on the ‘Sign Up’ button. You’ll be prompted to fill in some basic personal details like your name, email address, and a secure password. Once you’ve completed this initial setup, you’ll move on to the KYC (Know Your Customer) process. This step is crucial for verifying your identity and ensuring the security of your transactions on the platform.

The KYC verification is a one-time process where you will be required to upload identification documents such as a passport, driver’s license, or national ID. This secure process typically takes a short time, ensuring that your account is safe from fraudulent activities. Once your account has been verified, you can start exploring the full range of features Juuli offers. With straightforward instructions and helpful prompts, Juuli ensures that even those who are not tech-savvy can set up their accounts without any hassle.

Invoice Creation and Customization

Once your account is set up and verified, it’s time to create your first invoice using Juuli’s powerful tools. Start by navigating to the invoicing section of the platform and clicking on the ‘Create Invoice’ button. Here, you’ll find a variety of ready-to-use templates that make generating professional invoices quick and easy. You can add your business details, client information, and a breakdown of the services or products you’re billing for.

Juuli stands out with its customization options that allow you to tailor your invoices to match your brand’s identity. From adding your logo to changing the color scheme, every detail can be adjusted to reflect your personal or business preference. The intuitive design ensures your invoices not only look professional but are also easy to read and manage. You can save your favorite templates for future use, making the invoicing process even quicker next time around.

Sending and Receiving Payments

After creating and customizing your invoice, sending it off to your client is a breeze. Juuli allows you to send invoices directly through the platform, ensuring swift delivery and tracking. Once you’ve sent your invoice, you can easily monitor its status—whether it’s been viewed, approved, or is pending payment. This tracking feature takes out the guesswork, giving you peace of mind.

Setting up your bank account details on Juuli is straightforward and secure. You can enter your local bank account information to ensure that payments are received directly into your account. Juuli supports multiple payment methods and currencies, making it easy for international clients to pay you. Plus, with the added convenience of automatic currency conversion, you can avoid the complexities of dealing with foreign exchange issues. Just sit back, relax, and let Juuli handle the payment process for you.

By following these steps, you’ll be well on your way to effortlessly managing your invoices and payments with Juuli. No matter where your clients are located, Juuli’s robust suite of features ensures you get paid swiftly and securely.

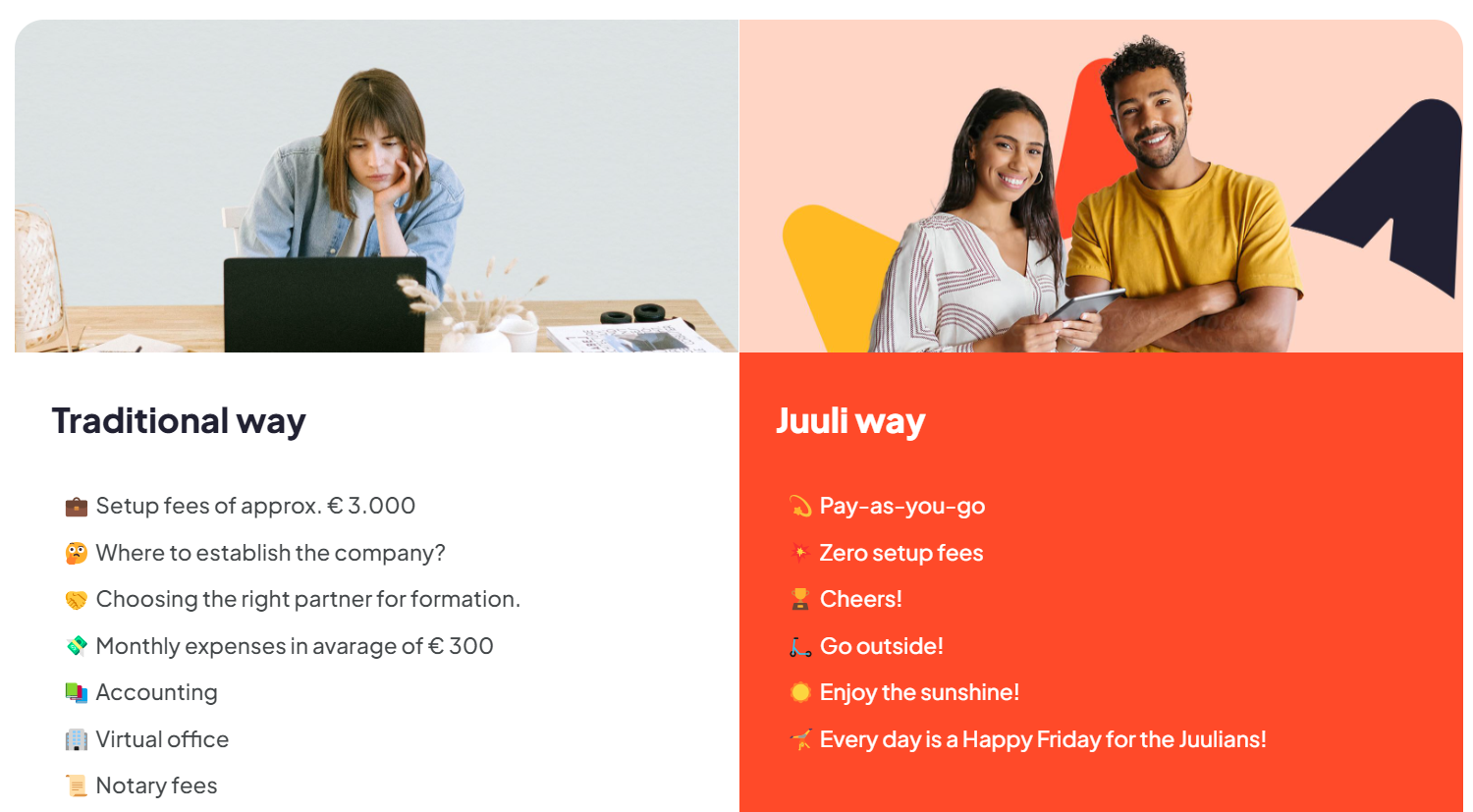

Juuli Pricing

When it comes to getting the best bang for your buck, Juuli’s pricing model is a standout. Instead of bogging you down with hefty upfront fees or regular monthly expenses, Juuli operates on a convenient pay-as-you-go basis. That means zero setup fees, so you can get started without any financial headaches.

And with Juuli, every day feels like a Happy Friday! Imagine venturing outside and enjoying the sunshine without worrying about mounting costs. Juuli’s transparent, all-inclusive 6% commission covers all currencies, ensuring that you’re not hit with unexpected charges.

Their approach eliminates the hassle and complexity of traditional financial services. No need to ponder over company setup fees, contemplate where to establish the company, or grapple with accounting complexities. Juuli takes that burden off your shoulders.

Plus, forget about additional costs like virtual office fees or notary expenses. Juuli’s pricing structure is designed to support growing businesses by offering the lowest rates in the market. Whether you’re invoicing in USD, EUR, or GBP, Juuli’s streamlined payment system and competitive rates help your business thrive. Embrace the ease and freedom Juuli offers, and focus more on what you love—growing your business and enjoying life.

Sign up for Juuli today and experience seamless invoicing and secure payments. Don’t miss out!

Benefits for Freelancers

Freelancers are continually searching for tools that can improve efficiency, save time, and provide seamless financial management. Juuli stands out in these areas, offering a robust platform designed with the unique needs of freelancers in mind. Let’s dive into how Juuli can benefit freelancers in terms of time and cost efficiency, flexibility and convenience, and enhanced financial management.

Time and Cost Efficiency

Juuli’s platform offers significant time and cost savings, which are essential for freelancers managing multiple projects with tight deadlines. The platform simplifies administrative tasks such as accounting and contract management. Freelancers can easily create, send, and track invoices, eliminating the cumbersome paperwork that usually comes with these tasks.

Additionally, Juuli provides competitive exchange rates and minimal transaction fees, ensuring freelancers keep more of their hard-earned income. The pay-as-you-go model with no hidden fees is particularly beneficial for freelancers who are wary of unexpected costs. Overall, Juuli helps freelancers maximize their earnings while minimizing the time spent on non-billable activities.

Flexibility and Convenience

Flexibility is a cornerstone of freelance work, and Juuli excels in providing a remote-friendly solution. Whether you’re a digital nomad working from a beach in Bali or a solopreneur managing clients from a home office, Juuli supports various lifestyles. The platform is designed to cater to international clients and offers multiple payment methods, making it incredibly convenient to receive payments from anywhere in the world.

Moreover, freelancers do not need a legal entity to use Juuli, simplifying the onboarding process. This flexibility and convenience make Juuli an ideal choice for freelancers looking to manage their finances effortlessly while focusing on their core work.

Enhanced Financial Management

Effective financial management is crucial for freelancers aiming for long-term success. Juuli simplifies record-keeping and offers efficient invoice tracking, which is vital for staying organized and preparing for tax season. The platform’s invoicing capabilities include customizable templates, allowing freelancers to reflect their personal or brand identity professionally.

Additionally, by handling both global and local currencies with automatic currency conversion, Juuli enhances the ease of working with international clients. This comprehensive financial management capability ensures that freelancers can focus on their projects without worrying about financial complications, setting them up for sustainable growth and success.

Simplification of Financial Processes

One of the standout benefits of choosing Juuli is the sheer ease it brings to managing your finances. You no longer need to juggle between multiple tools for invoicing, payments, and currency conversions. Juuli consolidates all these processes into a single, user-friendly platform. This integration means you spend less time worrying about the minutiae of financial management and more time honing your skills and expanding your business.

Moreover, Juuli alleviates the stress of handling diverse client payment preferences and various currency requirements. Whether your clients are local or international, the platform ensures payments are processed efficiently and securely. This seamless experience helps maintain positive client relationships and minimizes any roadblocks to your financial operations. By simplifying your financial processes, Juuli empowers you to dedicate your energy and creativity to your core craft.

Global Compliance and Security

In the world of freelancing and the gig economy, staying compliant with global financial standards can be daunting. Juuli takes this burden off your shoulders by ensuring all your transactions align with the relevant regulations, no matter where you or your clients are based. This compliance aspect is crucial for maintaining a trusted and professional image in a competitive market.

Moreover, security is a cornerstone of Juuli’s ethos. With robust security protocols in place, both your funds and personal data are safeguarded against potential threats. The peace of mind that comes from knowing your financial operations are secure is invaluable. Juuli’s focus on global compliance and security allows you to operate with confidence, knowing that your financial health is in good hands.

By offering these benefits, Juuli empowers freelancers to streamline their work processes, manage their finances efficiently, and ultimately, grow their freelance business.

Juuli vs. Xolo Go

As a freelancer, managing your invoices and payments can be a time-consuming and daunting task. Fortunately, there are several online tools available to help streamline this process. Two popular options in the market are Juuli and Xolo Go.

Let’s dive into a detailed comparison between Juuli and Xolo Go across several key metrics.

Usability and Accessibility

When it comes to usability and accessibility, Juuli excels by offering a seamless and intuitive experience for freelancers of all experience levels. The platform’s interface is designed with user-friendliness in mind, ensuring that invoicing, tracking payments, and managing financial records are straightforward tasks.

Even if you’re new to financial management tools, Juuli’s clean layout and straightforward navigation make it easy to get started without feeling overwhelmed. The setup is quick, and the features are accessible from any device, whether you’re working from a desktop, tablet, or mobile phone.

Compared to Xolo Go, Juuli’s platform stands out for its ease of access, enabling freelancers to focus more on their work and less on navigating complex software. This hassle-free approach makes Juuli the go-to choice for those looking to efficiently manage their finances while also maintaining flexibility and convenience.

Financial Oversight

When it comes to financial oversight, Juuli truly shines. Freelancers often juggle multiple clients and projects, requiring a robust system to manage and track finances. Juuli provides an intuitive dashboard that gives a clear overview of earnings, expenses, and outstanding invoices. This makes it easy to monitor cash flow and make informed financial decisions.

Moreover, Juuli’s integrated reporting tools simplify tax preparation, ensuring you stay compliant without stress. Say goodbye to the hassle of scattered spreadsheets and financial chaos; with Juuli, everything you need is in one place.

Whether you’re keeping tabs on monthly performance or preparing for tax season, Juuli’s financial oversight capabilities keep you organized and in control. In contrast, while Xolo Go offers basic financial tracking, it doesn’t match the comprehensive features and user-friendly design of Juuli. For freelancers who value clear, accessible financial management, Juuli is the go-to choice.

International Reach and Currency Options

When it comes to managing finances across borders, Juuli truly shines. This platform’s global flexibility makes it an excellent choice for freelancers who work with clients from all over the world.

Juuli supports multiple currencies, allowing you to seamlessly accept payments in various currencies without the hassle of converting them through an external service. This means you avoid hidden conversion fees and can maintain more of your hard-earned money.

Moreover, Juuli does not require you to have an overseas bank account, simplifying the entire process and making it incredibly user-friendly. This allows you to focus on delivering exceptional work to your clients rather than worrying about the complexities of international financial transactions. As a freelancer aiming to expand your global client base, Juuli provides the versatility and ease you need to thrive in the international market.

Pricing and Commission Structure

When it comes to pricing and commission structures, Juuli is ahead of the curve. Its transparent and competitive rates ensure that freelancers get to keep more of their hard-earned money. With Juuli, there are no hidden fees or unexpected charges; everything is laid out clearly, making it easy to see exactly what you’re paying for. This level of transparency is especially beneficial for freelancers who need to meticulously manage their budgets.

On the other hand, Xolo Go, while offering a decent service, often comes with higher commission rates that can cut into your profits. Juuli’s cost-effective approach, combined with its top-notch features, makes it a more attractive option for freelancers who want to maximize their earnings without compromising on quality or functionality. So, if you’re looking for an invoicing tool that offers great value and keeps costs low, Juuli is undoubtedly the way to go.

Safety and Regulatory Compliance

When it comes to safety and regulatory compliance, Juuli leaves no stone unturned. As a freelancer, you can rest easy knowing that Juuli is deeply invested in your financial protection. The platform employs state-of-the-art encryption methods to safeguard your sensitive information, ensuring that your data remains confidential and secure.

Moreover, Juuli is committed to staying current with ever-evolving tax laws and regulations, which can often be a headache for freelancers managing international clients. This means you can focus on your creative work without worrying about legal complications or compliance issues.

Additionally, Juuli’s transparent practices keep you informed every step of the way, offering peace of mind and a seamless user experience. All of these features collectively make Juuli the best option for freelancers who prioritize both efficiency and security in their financial transactions.

Integration Capabilities

When it comes to integration capabilities, Juuli shines brightly, providing freelancers with seamless connections to a variety of essential business tools. Whether you’re looking to sync your invoicing with your accounting software or need to integrate with popular project management platforms, Juuli makes it easy. Its robust API allows for effortless data transfer, eliminating redundant manual entry and the risk of errors.

Compatibility with widely used tools like QuickBooks, Trello, and Slack ensures you can create a cohesive workflow tailored to your needs. Juuli also supports integration with major payment gateways, allowing freelancers to offer clients multiple payment options without breaking a sweat.

This flexibility in integration not only saves time but also enhances productivity, making Juuli an indispensable tool for freelancers who value efficiency and functionality. With Juuli, managing your business has never been more straightforward or intuitive.

While both tools offer robust features, Juuli clearly outshines Xolo Go by providing a more user-friendly, cost-effective, and globally adaptable solution—making it the go-to choice for freelancers around the world.

Juuli vs Zoho Invoice

When freelancers seek an invoicing solution, simplicity, cost-effectiveness, and ease of use are often at the forefront of their considerations. Both Juuli and Zoho Invoice offer a range of features catering to these needs, but Juuli distinctly outshines certain critical areas.

Setup Fees

One of the top advantages of Juuli over Zoho Invoice is the absence of setup fees. While Zoho Invoice requires initial setup and possibly additional costs for unlocking premium features, Juuli streamlines the process right from the start. Freelancers can open a Juuli account in just five minutes with no upfront setup charges. This immediate, hassle-free start means users can focus on billing their clients and getting paid almost instantly without worrying about any hidden costs.

User Experience

Juuli prides itself on its user-friendly platform designed specifically for freelancers, eliminating unnecessary complexity. Zoho Invoice, while robust in features, can often be overwhelming with its myriad options and settings that require considerable configuration. Juuli bypasses this complexity with an intuitive interface that enables freelancers to manage invoices efficiently. There’s no need to navigate through intricate settings or deal with complicated procedures.

Cost Dynamics

Zoho Invoice’s tiered pricing plans can add incremental costs, especially as your business grows and requires additional features. In contrast, Juuli’s pay-as-you-go model offers transparent and competitive commission rates. With a 6% commission on most invoices and just 2% on TRY invoices, freelancers can predict costs better and avoid unnecessary overheads. Moreover, your first invoice through Juuli is completely free; not many platforms can boast such an offer.

Multi-Currency Convenience

Handling multiple currencies can be a hassle with some platforms, but Juuli simplifies this with dedicated multi-currency IBANs. This feature is particularly beneficial for freelancers working with international clients. Zoho Invoice also offers multi-currency support, but it requires additional steps and setup, adding to the user’s workload. Juuli’s streamlined process makes international transactions a breeze.

Security and Compliance

Freelancers often have concerns about security and compliance with tax laws. Juuli excels in providing enhanced security features and built-in tax compliance, ensuring peace of mind. While Zoho Invoice does offer secure transactions, the added layers of complexity can make it less clear and straightforward compared to Juuli’s transparent and secure framework.

Immediate Activation

Freelancers looking for a prompt payment solution will appreciate Juuli’s near-instant activation—sign up in just five minutes, and start getting paid in as little as ten minutes. This immediate functionality stands in stark contrast to Zoho Invoice, where account setup and feature configuration may delay the invoicing process.

While Zoho Invoice is a competent invoicing solution suitable for many small businesses, Juuli stands out as the optimal choice for freelancers seeking an efficient, cost-effective, and user-friendly invoicing platform.

Juuli’s lack of setup fees, intuitive design, competitive pricing, and swift activation make it the leading option for freelancers who wish to focus on their work rather than their invoicing processes. Juuli’s commitment to simplicity, transparency, and security ensures that freelancers have a reliable partner to manage their invoicing needs effortlessly.

Revolutionize Your Freelancing Finances with Juuli

Juuli is reinventing the freelancing landscape with its innovative and user-friendly financial solutions. From start to finish, Juuli manages finances effortlessly with robust invoicing capabilities, comprehensive payment features, and advanced tools like the dedicated multi-currency IBAN.

Freelancers can enjoy the flexibility of a pay-as-you-go model, ensuring they only pay for what they use, without any hidden fees. The platform’s ability to streamline the payment process by accommodating multiple payment methods and handling both global and local currencies is a game-changer, eliminating the hassle of international bank transactions.

Moreover, Juuli’s focus on security and compliance ensures that freelancers can trust their data and transactions are safe. The customizable and professional invoice templates further enhance the user experience, allowing freelancers to present their services with added polish and professionalism.

By integrating seamlessly with essential tools like debit cards and credit lines, Juuli provides a holistic financial ecosystem tailored to the unique needs of the gig economy. If you’re a freelancer looking to simplify your financial management while maintaining the highest standards of professionalism, Juuli is the platform for you. Don’t wait; sign up today and take the first step toward a more organized, efficient, and successful freelancing career with Juuli.

Enjoy effortless compliance and robust security for your freelance work by signing up for Juuli now!